Bill Morecraft

Senior Vice President

Shipments on the March ABC Position Report landed ahead of industry expectations totaling 193.9 million lbs, 9% ahead of prior year. Year to date 2017 crop year shipments are now 169 million lbs, and 12%, ahead of last year. Domestic shipments posted a 12.5% increase over last March and are now up 6.5% YTD. Total export shipments were up 7% on the month and now total 14% growth on prior year. Most geographic regions remained steady with Europe posting the most significant growth, 17%+ over prior year.

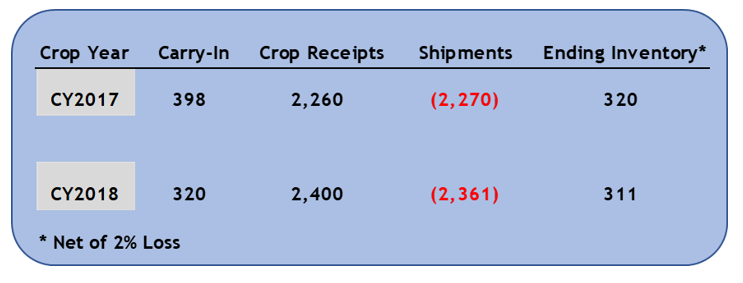

The 2017 almond crop will settle in at ~2.260 billion lbs, a 6% increase in total supply over the 2016 crop. With year to date industry shipment growth 12% ahead of last year, and quality issues limiting saleable supply, a tight transition into crop year 2018 can be expected.

YTD shipments and commitments through March total 2,058 million lbs. The 2017 crop supply is 80% committed with 4 months remaining. Assuming April through July shipments are flat to last year, ending inventory would be brought down to an unworkable 320 million lbs, 78 million lbs less than prior year.

| Market Perspective

Over a 20-year horizon, the California almond industry has experienced an annual growth rate in shipments of 7%. If drought years are excluded, the annual growth rate is even higher. As we approach the 2018 crop year, the early freeze conditions make a 2.4 billion lb crop unlikely. With any crop less than 2.4 billion lbs, even modest shipment growth of 4% would take ending inventory below 310 million lbs, barely six weeks of supply for an eight to twelve week transition period. Almond demand continues to grow globally at rates that exceed the growth in supply. With the minimal amount of available quality product remaining in the 2017 crop, firm pricing can be expected as booking for new crop begins. |

Click here to view the entire detailed Position Report from the Almond Board of California site: