Bill Morecraft

Senior Vice President

Shipments of California almonds reported on the May 2018 ABC Position Report were 158.2 million lbs. Tight inventory positions continue to be reflected in current market pricing. Ending inventory projects close to 325 million lbs, which will mean global shipments in June & July slightly below last year. YTD shipments remain at increases greater than 10% in both the U.S. and in export markets. YTD, China is up 19%, Viet Nam up 26%, India up 22%, Europe up 10%, and a small YTD decline in the Middle East (primarily in Saudi Arabia).

2017 crop commitments in May were 76.1 million lbs (though fewer handlers reported commitments this month than they did last month). While uncommitted inventory computes slightly higher than last year, the poor quality of the 2017 crop will result in year-end adjustments that will reduce the total supply, as actual loss exceeds the forecast 2%.

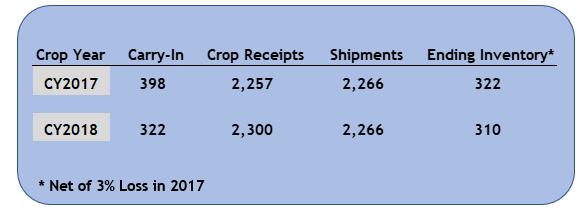

New crop commitments of 80.8 million lbs are 3.1% of projected 2018 supply (325 million carry-out + 2.3 billion Subjective Estimate) net of loss. On last May’s Position Report, when new crop commitments were reported for the first time, the commitments were 209.3 million lbs or 8.0% of eventual supply.

The uncertainty surrounding duties and tariff has caused buyers to pause in some markets. In India and China, strong demand potential exists but buyers want to know the import environment before committing to product. Both these markets have enjoyed significant increase in almond imports in recent years. In normal circumstances, we would expect continued growth in 2018. With the retaliatory duties being discussed, in a worst case, we may see these markets importing at a slightly lower rate.

The graphic above calculates June-July shipments of 2017 crop slightly below last year, with carry-out inventory still ending close to 325 million lbs. The limited seven weeks of supply will result in some short-term spikes in pricing for items in the most demand.

Using the 2018 Crop Subjective Estimate of 2.3 billion lbs, and assuming a worst-case scenario of no growth in shipments, the 2018 crop carry-out inventory would also end at an unsustainably low at seven weeks of supply. Over the next 90 days, we will get increasing clarity on both the 2018 crop and the status of trade in individual markets.

|

Market Perspective With the NASS Subjective Estimate at 2.3 billion lbs, and strong year-over-year growth in demand, the almond industry is facing historically tight supply as we transition crops. The combination of a 2.3 billion lb Subjective Estimate and diminishing 2017 crop inventories are reflected in increased current crop pricing. Three key things will influence the 2018 crop outlook over the summer months: · Continued growth in global consumer demand · Results of ongoing trade negotiations · The July 5 Objective Estimate. |

Click here to view the entire detailed Position Report from the Almond Board of California site: