Laura Gerhard

Vice President

OVERVIEW

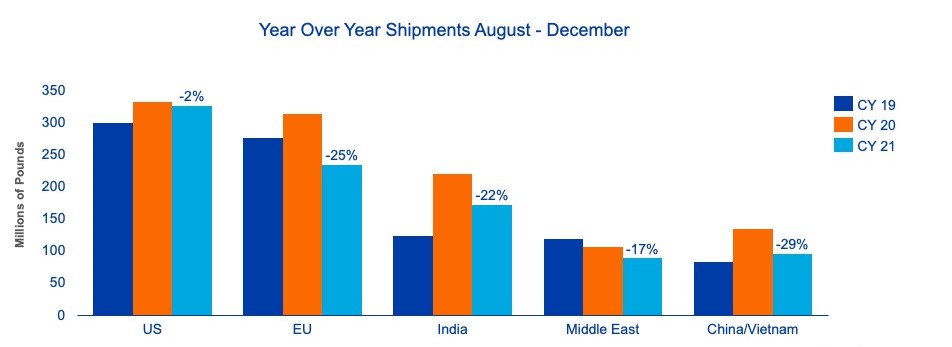

The California almond industry posted December shipments of 188.8 million lbs, a 26.5% decline compared to last year’s record of 256.9 million lbs. The shipment number came in slightly lower than market expectations. As expected, export numbers declined, down 71.6 million lbs for the month, which is 36.5% lower than last year. Domestic demand was a bright spot, setting a new December record of 64.3 million lbs, a 5.8% increase for the month. After the first 5 months, global shipments now stand at 1.061 billion lbs, a 17% decline and 221.9 million lbs lower than last season. Export markets represent 215.4 million lbs of the total decline.

SHIPMENTS

Vessel logistics continue to complicate execution and impact traditional shipment patterns and cadence leading to the fourth consecutive month of declines for export markets.

India: Shipments are down 22% year-to-date. However, this decline can be viewed as an opportunity for the local almond supply to balance and even tighten as the market moves forward with demand continuing. Reports show that almonds and dried fruits are the number one food items being sold, in part due to the immunity nut tag for almonds which is having an impact on e-commerce sales. An early Diwali next year will require India to buy product for the festival out of this year’s supply, relieving some pricing pressure for patient sellers.

China: Lost consumption is evident with November and December shipments. Year-to-date shipments are down 29% or 33 million pounds. This reduction is a direct result of vessel and logistical issues in areas where transit times are over six weeks. Vessel delays and longer transit times required product to be shipped by mid-November to make Chinese New Year sales. In previous years the industry could ship through the end of December and still have product arrive in time for the Chinese New Year consumption.

Europe: The market pulled heavy last spring and summer to alleviate shipment delays and ensure supply heading into the Christmas season. Furthermore, buyers bought heavy recognizing the affordable prices in California. European shipments to date stand 25% below last year though we are seeing European customers begin to replenish supplies. The Spanish crop helped fill demand because of fewer logistical challenges for Intereuropean destinations.

Middle East: Shipments were behind by 17% but an early Ramadan this year is providing some relief going forward as we review November and December shipments.

Domestic: US shipments remained steady and reliable with no major trends impacting the region. Year-to-date shipments are down 1.9% or 6.5 million pounds. Shipments for December totaled 64 million lbs compared to 60 million lbs last year, a strong 5.8% increase for the month.

CROP COMMITMENTS

Total commitments at 811 million lbs are down 12% compared to last December. New sales for the month were a bright spot coming in at 246 million lbs which is a record for the month and the highest of the 2021 crop season. Domestic sales continue to be steady at 61 million lbs with export having a stronger month at 184 million pounds. Sold and shipped as a percent of total supply is at 56% vs 63% last year. Uncommitted inventory is at 1.339 billion lbs, up 26.7% from a year ago. With five months into the year, even if industry shipments amount to last year’s record numbers for the next seven months, there would inevitably be carryout of over 700 million pounds. Due to vessel logistics complicating execution for the foreseeable future, lost consumption in some markets and higher levels of uncommitted inventory versus prior years, pricing will continue to be under pressure.

HARVEST

Crop receipts at 2.656 billion lbs for December continued to trend lower than last year, down 7.4%. The crop is likely to be larger than the 2.8-billion-pound NASS Objective Estimate, tracking to 2.9 billion lbs.

|

Market Perspective December shipments came in low with export shipments continuing to be challenged and US shipments remaining steady and reliable. There were many signs pointing to this being a difficult month with many markets having sufficient nearby inventories putting little to no pressure on buyers to cover demand any sooner than necessary. Total commitments were a bright spot driven by strong export sales for December. Export sales are predicted to increase further in coming months with the expectation that demand starts to pick up signaling the need to replenish inventories. Although price had been relatively stable since the November report, going forward it is likely to see some pressure as the industry will focus on managing the carryout for this crop year. California received good rains over the month of December though it will take sustained precipitation over the next few months for conditions to fully return to normal. Vessel logistics continue to complicate pipelines. It remains prudent for buyers to purchase earlier than anticipated to avoid further complications. Next major milestone for the market will be the bloom. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here